(slitting steel process)

The slitting steel process is a vital mechanical operation pivotal to the metals and manufacturing industries. As global infrastructure development and technological demands escalate, the precision and reliability of metal products have become non-negotiable. According to the World Steel Association, the annual production of rolled steel topped 1.95 billion metric tons in 2023, with over 30% processed using slitting techniques. This process delivers custom-sized strips from master coils—enabling downstream forming, stamping, and automated assembly with minimal waste and cost. As industries from automotive to construction push for tighter tolerances and fast throughput, mastering the steel slitting process directly translates to competitive advantage and operational excellence.

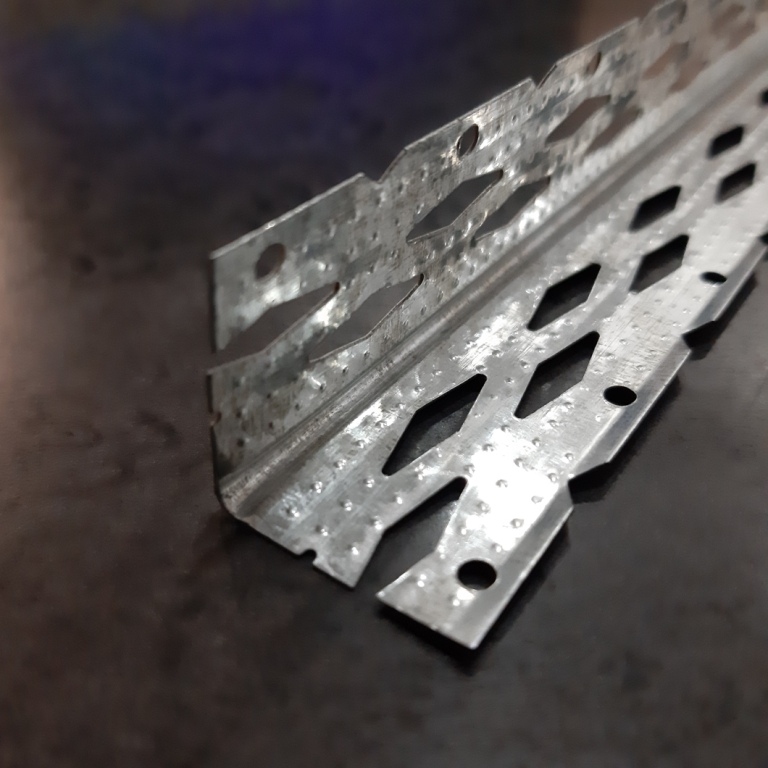

At its core, the steel coil slitting process involves feeding a wide master coil of steel through rotating knives or rotary shears that precisely cut the material lengthwise. This transforms the coil into several narrower strips, called "mults," matching exact customer specifications. The process commences with uncoiling, leveling, slitting by tooling sets, and finally recoiling the slit strips. Operators must remain vigilant against common defects such as burrs, camber, or edge waviness. Key controllable parameters include line speed, knife clearance, tension, and material thickness—which can range from ultra-thin 0.18 mm for electronics to robust 12 mm for heavy machinery. Modern slitting lines are highly automated, achieving line speeds up to 400 m/min and processing coils weighing up to 40 tons. These advancements allow flexible batching and just-in-time delivery for lean manufacturing environments.

In the last decade, digital controls and advanced metallurgy have revolutionized the steel slitting process. Data integration now enables feedback loops maintaining ±0.05 mm width tolerance even at high throughput. The adoption of laser-guided edge detection and real-time force sensors has reduced scrap rates by up to 18%. Furthermore, integration with ERP and MES systems ensures full traceability—a necessity for ISO 9001 and IATF 16949 certification. Environmentally, the optimization of knife materials and energy-efficient motors has decreased operational power consumption by 12%, according to a 2022 survey among Tier 1 slitting centers. The table below illustrates key performance comparisons for industrial-grade slitting lines:

| Manufacturer | Max Line Speed (m/min) | Width Tolerance (mm) | Min/Max Thickness (mm) | Max Coil Weight (tons) | Annual Scrap Rate (%) |

|---|---|---|---|---|---|

| Flextrol Systems | 400 | ±0.05 | 0.15 - 10 | 40 | 1.9 |

| Krupp Precision | 350 | ±0.08 | 0.2 - 7 | 32 | 2.5 |

| Alpine Tech | 380 | ±0.10 | 0.18 - 12 | 36 | 2.0 |

| Masterline Steel | 320 | ±0.07 | 0.25 - 8 | 27 | 2.3 |

Clearly, technological edge and precision machinery directly translate into measurable efficiency and quality improvements for stakeholders across the supply chain.

The steel slitting process market is highly competitive, with both legacy and new-generation manufacturers vying to deliver the best performance and value. Flextrol Systems leads in both maximum throughput and width tolerance, making it the preferred choice for high-spec applications like EV battery components and aerospace. Krupp Precision continues its dominance in automotive supply chains due to exceptional quality consistency and integrated diagnostics. Alpine Tech offers the widest thickness range, supporting clients in both light-gauge electronics and heavy-plate sectors. Masterline Steel has found its niche in mid-volume, quick-changeover projects for HVAC and construction. When specifying a supplier, crucial decision factors include not only mechanical specifications but also after-sales support, tooling life, digital integration, and proven compliance to regulatory standards. For instance, Tier 1 suppliers typically demand real-time production data export and predictive maintenance tools to align with smart manufacturing objectives.

Customizability in the steel slitting process is vital for competitive manufacturing. Industry-leading providers offer modular knife assemblies, quick setup slitting heads, and programmable tension systems tailored for various alloys (carbon, stainless, electrical, pre-painted steels). For automotive lightweighting initiatives, ultra-narrow slitting (down to 5 mm) with edge-camber correction is essential. In electrical transformer manufacturing, burr-free slitting with insulation paper application is a critical requirement. Integrated digital controllers enable batch recipe management, instantly switching parameters to handle different coil geometries or end-use specifications. Further enhancements, such as automatic defect marking, residual stress monitoring, and online surface inspection, are increasingly standard in European and East Asian slitting centers. Thus, it is now possible to offer highly customized, certified-to-order coil strips with minimal loss and optimal flatness within just a few days of receiving OEM requirements.

End-to-end integration of the steel slitting process unlocks significant competitive advantages in global manufacturing. For example, a Japanese HVAC producer reported a 16% total processing time reduction after migrating to a digital edge-guided slitting line, translating to a $310,000 annual cost saving. In another case, an American automotive tier supplier realized a 95% reduction in part rejection by adopting high-tolerance slitting for ultra-high strength steel coils. Additionally, a German appliance manufacturer managed to consolidate four previous suppliers into a single, high-efficiency slitting partner, improving both logistics and sheet metal consistency. These success stories underline how modern slitting capabilities not only enhance downstream fabrication but also improve inventory agility and strengthen business resilience against volatile market demands.

Excellence in the slitting steel process now relies on technological leadership, data integration, and customer-driven flexibility. The latest advances in slitting automation, combined with sophisticated feedback and quality assurance systems, continue to drive down costs, minimize errors, and support demanding industrial trends like miniaturization and electrification. As manufacturing ecosystems become more interconnected and quality expectations toughen, investing in robust, future-ready slitting solutions ensures optimal material performance and sustained competitive advantage. Strategic collaboration with technologically advanced slitting centers will be the defining factor for success in the next generation of metal product innovation.

(slitting steel process)