(ceiling channel roll forming machine price)

Current market dynamics place unprecedented pressure on manufacturers to optimize production costs while maintaining quality standards. The average price range for ceiling channel roll forming machines ($48,000-$115,000) represents a critical capital expenditure decision. Production directors must balance initial investment against tangible ROI metrics: modern roll forming lines typically reduce material waste by 18-22%, lower labor requirements by 30-40%, and increase output speeds to 30-45 meters/minute. Leading manufacturing plants replacing manual fabrication with automated roll forming systems report payback periods of 14-18 months, transforming operational economics for drywall channel production.

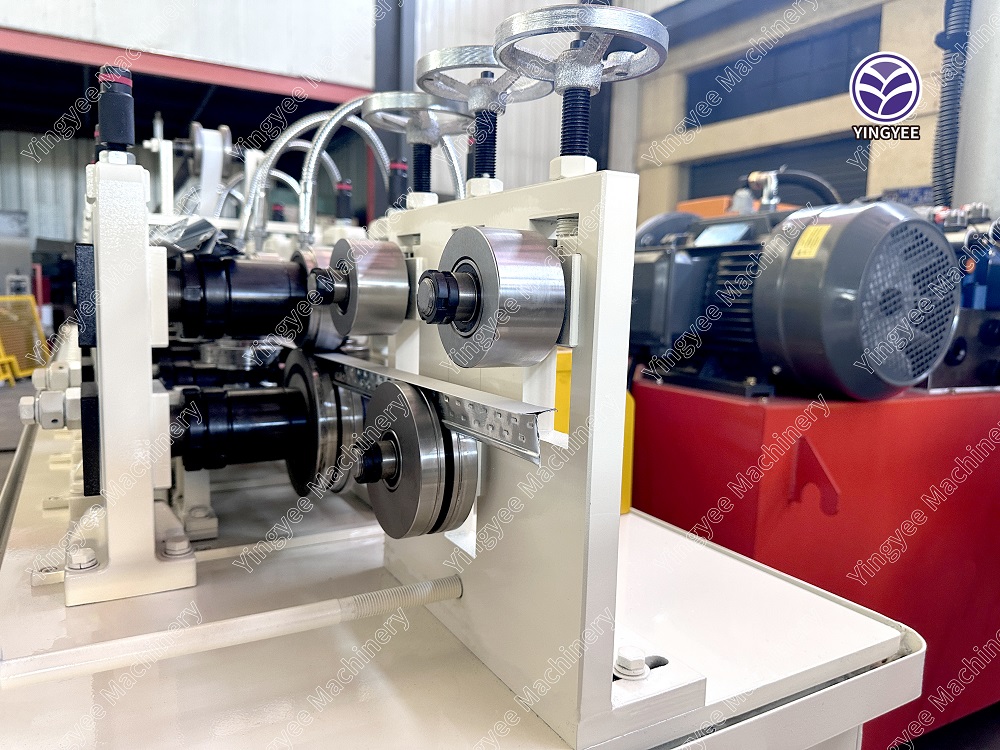

Contemporary roll forming technology integrates precision engineering with operational intelligence. The most efficient machines feature laser-calibrated servo systems achieving dimensional accuracy within ±0.15mm and automated tooling changeovers in under 3 minutes. Sophisticated PLC controls enable seamless switching between C-channel, wall angle, and main channel profiles without downtime. Modern safety integration reduces workplace incidents by 40% compared to conventional systems, while energy-efficient servo motors cut power consumption by 32%. These technical advancements directly impact production metrics: manufacturers report 27% higher hourly throughput and 60% reduction in material calibration errors when upgrading to premium roll forming systems.

| Configuration Feature | Basic Model ($48K) | Advanced System ($78K) | Premium Production Line ($115K) |

|---|---|---|---|

| Forming Stations | 12 | 18 | 24 |

| Max Production Speed | 25 m/min | 35 m/min | 45 m/min |

| Tooling Change Time | 15 min | 7 min | <3 min |

| Material Utilization Rate | 86-89% | 91-93% | 96-98% |

| Profile Accuracy Tolerance | ±0.30mm | ±0.20mm | ±0.15mm |

| Automation Integration | Manual | Semi-Auto | Full Auto |

The industrial machinery landscape presents varied capability tiers across regions. European manufacturers dominate the premium segment with IoT-enabled machines featuring predictive maintenance systems that reduce unscheduled downtime to under 2%. Chinese suppliers offer competitively priced alternatives ($48,000-$65,000) with shorter lead times (4-6 weeks) but often require additional calibration to meet international tolerance standards. North American producers excel in mid-range solutions ($72,000-$95,000) balancing robust construction with simplified maintenance protocols. Each OEM brings distinct advantages depending on production volumes, technical support requirements, and specific ceiling channel applications (drywall, acoustic, seismic).

Production requirements dictate optimal machine configurations, with significant price implications. For standard drywall track manufacturing, a 16-station configuration with hydraulic punching satisfies 85% of requirements at approximately $64,000. Facilities producing seismic-rated components require reinforced structural frames and secondary locking systems, increasing investment by 20-25%. Operations focusing on niche profiles (curved ceiling channels, HVAC integration) benefit from modular tooling systems allowing future expansion without complete system replacement. Production analysis reveals that tailored machine specifications typically yield 17% greater efficiency versus adapting generic equipment to specialized requirements.

Actual implementations demonstrate measurable performance improvements post-installation. A UAE-based manufacturer recorded a $438,000 annual cost reduction after implementing a $107,000 roll forming system, eliminating three manual fabrication stations while increasing daily output from 3,200 to 8,500 linear meters. Similarly, a Philippine contractor reduced ceiling installation timelines by 40% using precisely-formed main channels, decreasing labor costs by $7.50 per square meter. These case studies validate that strategic equipment investments focusing on total operational economics rather than merely purchase price consistently yield superior financial returns within 24 months.

Informed procurement requires multi-dimensional evaluation beyond initial price considerations. Production directors should assess operational metrics including energy consumption patterns (premium servo systems consume 3.8kW vs. standard 5.2kW motors), ongoing maintenance overheads (predictive systems cut annual service costs by 45%), and technical adaptability for future product lines. Leading operators implement lifecycle cost analysis models weighing purchase price against eight-year operational expenses. Data indicates that optimal choices typically split preferences: 65% of mid-volume manufacturers select advanced systems ($68,000-$92,000) while large-scale operations justify premium solutions for their flexibility advantages. Proper specification avoids costly redesigns while future-proofing production capabilities.

(ceiling channel roll forming machine price)

A: The price typically ranges from $15,000 to $100,000+, depending on the machine's configuration, automation level, and production capacity. Customizations and brand reputation also significantly influence costs.

A: Key factors include material thickness compatibility, motor power, roll tooling complexity, and automation features. Higher-speed machines with advanced controls and durable components usually cost more.

A: C channel machines are often cheaper (starting around $10,000) due to simpler designs, while main channel machines may cost $20,000+ for heavy-duty profiles. Prices vary based on technical specifications and output requirements.

A: Yes, costs like shipping, installation, training, and maintenance contracts should be considered. Custom tooling or spare parts may also add to the initial investment.

A: Brands like FormTec, SAMCO, and Hengli provide cost-effective options starting at $12,000. Balancing budget with after-sales support and machine durability is crucial for long-term value.